how does debtor finance work

And because the ledger is the main security for the loan business owners dont need to use real estate as security. Once the invoices are approved by the funder a debtor financing facility is set up based on the value of accounts receivable.

Debtor Meaning Examples Prison How It Works

Debtor finance also allows relatively quick access to cash compared to other types of financing and develops with your business.

. In a situation like this there are few financing options but one that is designed specifically for these issues- debtor finance facilities. Know Your Options with AARP Money Map. Ad Get Helpful Advice and Take Control of Your Debts.

Debtor Finance is a full ledger facility. These solutions improve your working capital by financing your accounts receivable ledger. What is debtor finance and how does it work.

It introduces a financial intermediary a third party into the buyer-supplier relationship. Basically most companies that provide goods or services and raise invoices with normal payment terms usually between 30-90 days are able to get an advance on the monies owed. Invoice finance is a specific type of Debtor Finance.

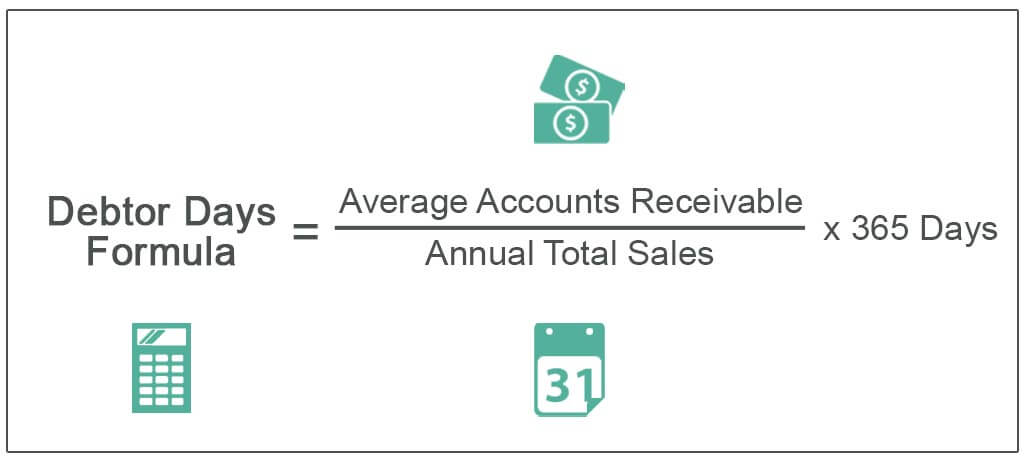

Debtor finance allows businesses to finance their receivables and release the cash tied up in their unpaid invoices. A Debtor Finance Facility is where a loan is raised for working capital purposes using a customers debtor book accounts receivable as security. Debtor finance is a process to fund a business using its accounts receivable ledger as collateral.

The loan amount is based on outstanding invoices. But how does trade finance work. Subject to certain restrictions the bank will immediately make funds available equating to a defined percentage of the value of the approved invoices.

Debtor finance solutions fund slow-paying invoices which improves the cash flow of the company and puts it in a better position to pay operating. Debtor finance is a general term that usually describes two solutions factoring and invoice discounting. This type of financing gives you more control over cash flow and provides better credit control.

Pay suppliers and negotiate discounts for early payments Offer extended payment terms to large customers Increase stock levels for peak sales seasons Take on new staff to increase workload capacity Purchase or upgrade equipment Avoid using your home as collateral to. When a business needs to unlock cash flow it may be possible to sell unpaid invoices to a third-party lender who advances funds against the value of those invoices. Furthermore debtor financing is more flexible compared to overdrafts or bank loans as these are limited by amounts of attached security.

The business can then access the available funds as required. Supply chain finance is a smart financing option that offers buyers and suppliers an opportunity to work together to stabilise both parties cash flows. Debtor finance solves mismatches in cash flow giving business owners access to already earned cash.

It is a financial tool that helps entrepreneurs like you pay for slow-paying invoices by augmenting your working capital. There are two common types of debtor finance which are invoice factoring. The factoring programme helps small and growing companies that need funding and credit controls.

Trade finance can help to plug the gap by immediately funding a transaction so the supply chain can continue uninterrupted. It helps businesses to cover the gap of slow payments by getting their invoices paid in as quick as 4 hours instead of waiting up to 90 days for their clients to pay. Generally companies that have low working capital reserves can get into cash flow problems because invoices are paid on net 30 terms.

With debtor finance you can tap into the finance and invoice as sources of funds to continue working with. However success is contingent upon the individuals willingness to conquer their debt and work at it over time. How does Debtor Finance Work.

The financier then verifies the invoices and advances up to 90 per cent of the unpaid invoice value within 24 hours. This type of finance is an alternative to an overdraft facility of which is secured by property. Invoice Financing is a selective invoicing facility.

How does Debtor Finance work. The debt snowball method can be a powerful tool for individuals with debt and should not be overlooked. Think of supply chain finance as an innovative hybrid of trade finance and debtor finance.

With debtor finance the lender will analyse the unpaid invoices of a business to determine the risk involved. Debtor finance is a way to fund your business by using outstanding invoices to get finance. With debtor finance a business can typically draw up to 80 of their accounts receivable ledger ahead of payment.

Free to Use for Ages 18 Only. Even in the current uncertain times trade finance can help to shore up businesses that are feeling the strain or provide them with funding for new opportunities. The business sends invoice details to the debtor finance lender to verify the amount owing and the date the invoice was issued.

With it you can pay important expenses without running into cash flow issues. Debtor finance enables you to. Access to funding is scalable growing as sales grow.

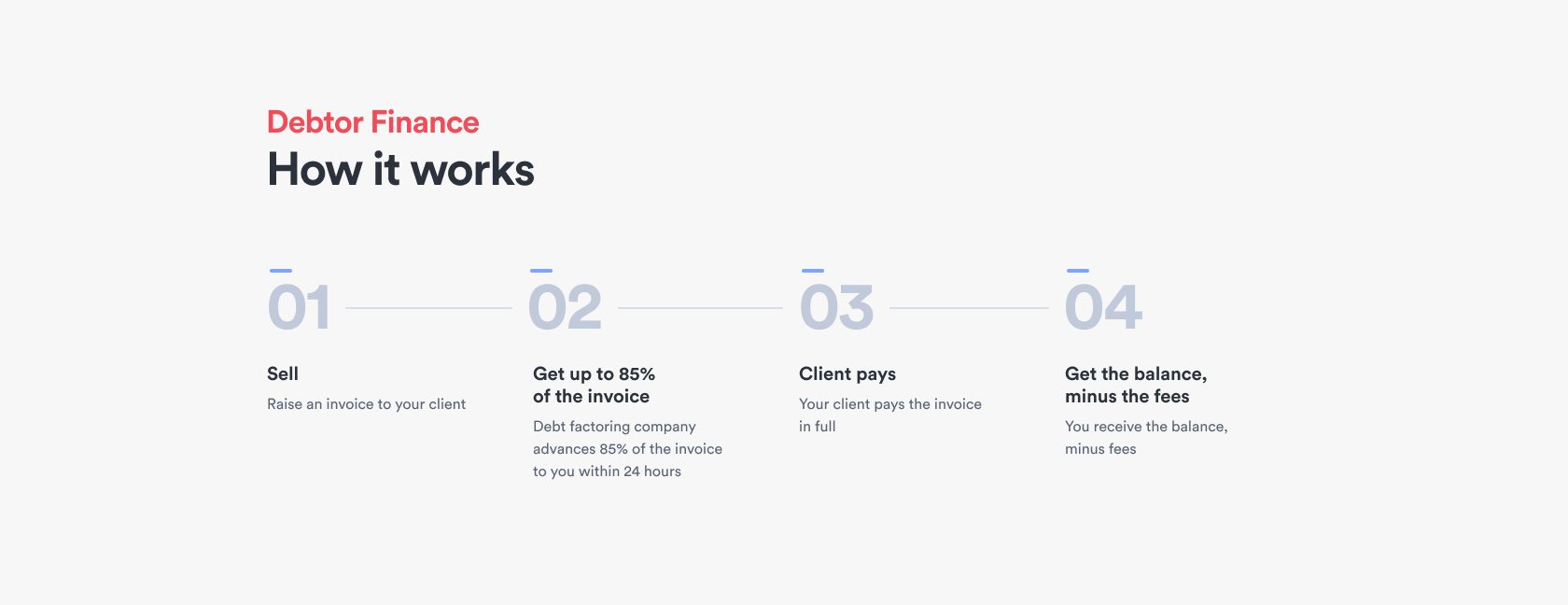

How Does Debtor Finance Work. How Does Debtor Finance Work. How does it work.

Instead of waiting for invoices to be paid a finance provider will give you immediate access to a percentage of the invoice as a line of credit in return for a fee. Invoices that have been sent to debtors are also sent to the bank. Whats great about it is that property security is not usually required.

How does debtor finance work. How it works. Debtor finance can be disclosed or undisclosed to your customers.

This debt reduction method can be a great way to start with simple expenses and work your way up to the bigger expenses. As a business delivers goods and services to its customers the invoices trade debts raised are forwarded to the financier. All invoices are subject to the debtor finance arrangement.

How does debtor finance work. Debtor finance turns unpaid invoices into quick efficient cash flow for growth and other business purposes. Debtor finance also known as cash finance is one of the most popular financing options for growing business in Australia.

Generally this can be 75 to 85 of the value of the invoice. Debtor Finance allows you to take out a loan using your slow-paying invoices as security providing access to working capital to keep your business running smoothly. Debtor financing works by forwarding your chosen issued but as of yet unpaid invoice to a provider.

Want To Better Understand Factoring Products Call 1300 00 8332 Http Www Tradedebtorfinance Com Au Services Factoring De Finance Advice Understanding Finance

Tdfc Has Been Explaining Factoring To Small Business For 7 Years Http Www Tradedebtorfinance Com Au Services Factoring Small Business Finance Advice Business

Invoice Factoring Finance Trade Finance Business Loans

Debtor Vs Creditor Top 7 Best Differences With Infographics

Modules Guide Debtors Financial Statement Impacts Modano

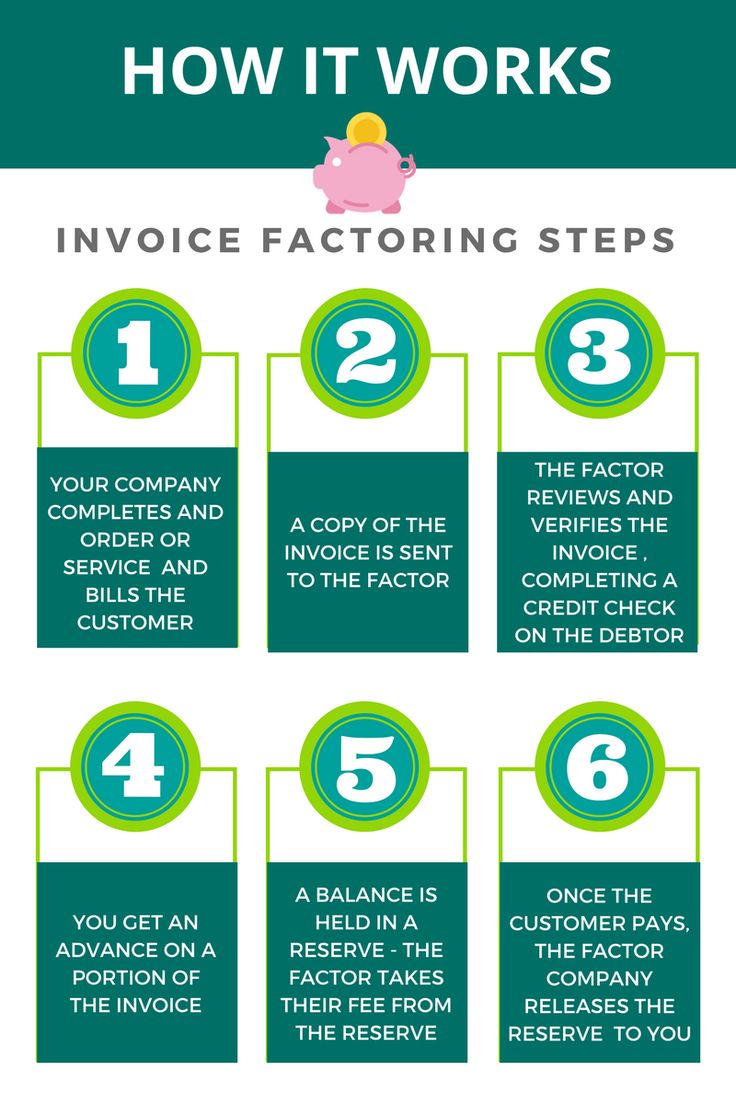

How Does Invoice Factoring Work Follow The Step By Step Process Small Business Resources Staffing Agency Staffing Company

How Does Debt Factoring Improve Cash Flow

Trade Debtor Finance Consultants Explained Finance Finance Advice Trading

Belum ada Komentar untuk "how does debtor finance work"

Posting Komentar